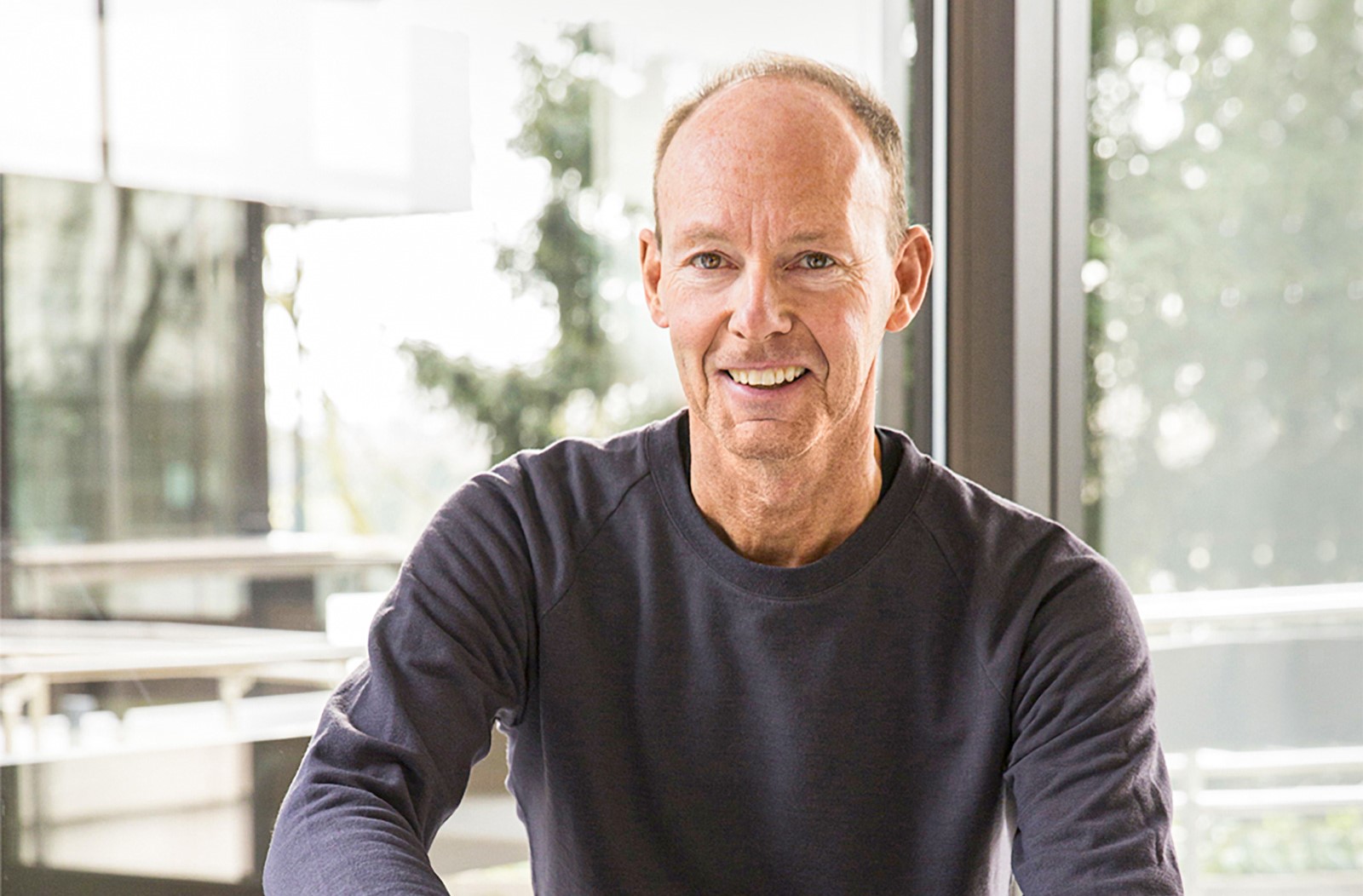

Thomas Rabe

Chief Executive Officer of RTL Group

2022 was a strong year for RTL Group, despite numerous external challenges – the war in Ukraine, inflation, rising energy prices and supply chain disruptions. With our highly profitable TV broadcasting and rapidly growing streaming and content businesses, RTL Group once again generated strong financial results.

RTL Group’s revenue increased by 8.8 per cent to a record level of €7.2 billion, exceeding €7 billion for the first time in the Group’s history. Revenue growth was driven by scope effects at RTL Deutschland and higher revenue from Fremantle and RTL Nederland. Due to the strong performance of these two business units, Group revenue was up 1.6 per cent organically, despite lower TV advertising revenue from our two largest broadcasting operations in Germany and France.

RTL Group’s full-year Adjusted EBITA decreased 6.0 per cent to €1,083 million. This was mainly due to higher streaming start-up losses, which increased from €166 million in 2021 to €233 million in 2022. With our families of TV channels in Germany, France and the Netherlands continuing to generate high operating profits, our Adjusted EBITA before streaming start-up losses remained stable, on the same record level as last year.

RTL Deutschland gained audience shares and increased its lead over its main commercial competitor ProSiebenSat1. The free-to-air channels of Groupe M6 scored their best primetime audience share ever, and once again generated an Adjusted EBITA of more than €300 million. RTL Nederland had a fantastic year, gaining audience shares, while growing its streaming service Videoland. As a result, RTL Nederland’s Adjusted EBITA was up 50 per cent to €161 million. Our global content business Fremantle also reported its highest Adjusted EBITA ever, which was up 15 per cent to €162 million.

To summarise: RTL Group combines high earnings, cost discipline and significant investments in content, streaming, tech & data. On this basis, the Group’s Board of Directors has proposed a dividend of €4.00 per share for 2022 including €0.50 that relates to the disposals of RTL Belgium and RTL Croatia. This proposal is in line with our dividend policy and represents a dividend yield of 9.5 per cent.

RTL Group’s strategy, which is based on three priorities, remains unchanged. Firstly, to strengthen RTL Group’s core businesses by investing in premium content, strengthening our families of channels, focusing on cost control and portfolio management, and driving market consolidation. Secondly, to expand the Group’s growth businesses, in particular our streaming services, advertising technology and addressable TV, and global content production from Fremantle. And finally, to foster alliances and partnerships which span from advertising sales and content production to tech & data.

Below, I will provide more detail on our achievements in our growth businesses of streaming and content, which progressed significantly in 2022.

We continued to invest substantially in premium content across all genres – from news to fiction, live sports, entertainment shows and reality TV. Exclusive content strengthens our linear TV channels and is key to gaining new subscribers for our streaming services. RTL Deutschland signed agreements with Warner Bros. Entertainment and Paramount Global for attractive programme packages and acquired extensive rights for live sports events, such as football matches from the German national team, the Uefa Europa League and the US National Football League (NFL), including the Super Bowl. In France, Groupe M6 will air matches from the 2023 Rugby World Cup, the Uefa Euro 2024 and the finals of the Uefa Champions League from 2025 to 2027.

In total, RTL Group’s TV broadcasters and streaming services invested €2.3 billion in programming during 2022. In our business, content is the basis for success – and we are committed to maintaining a high level of programme investment.

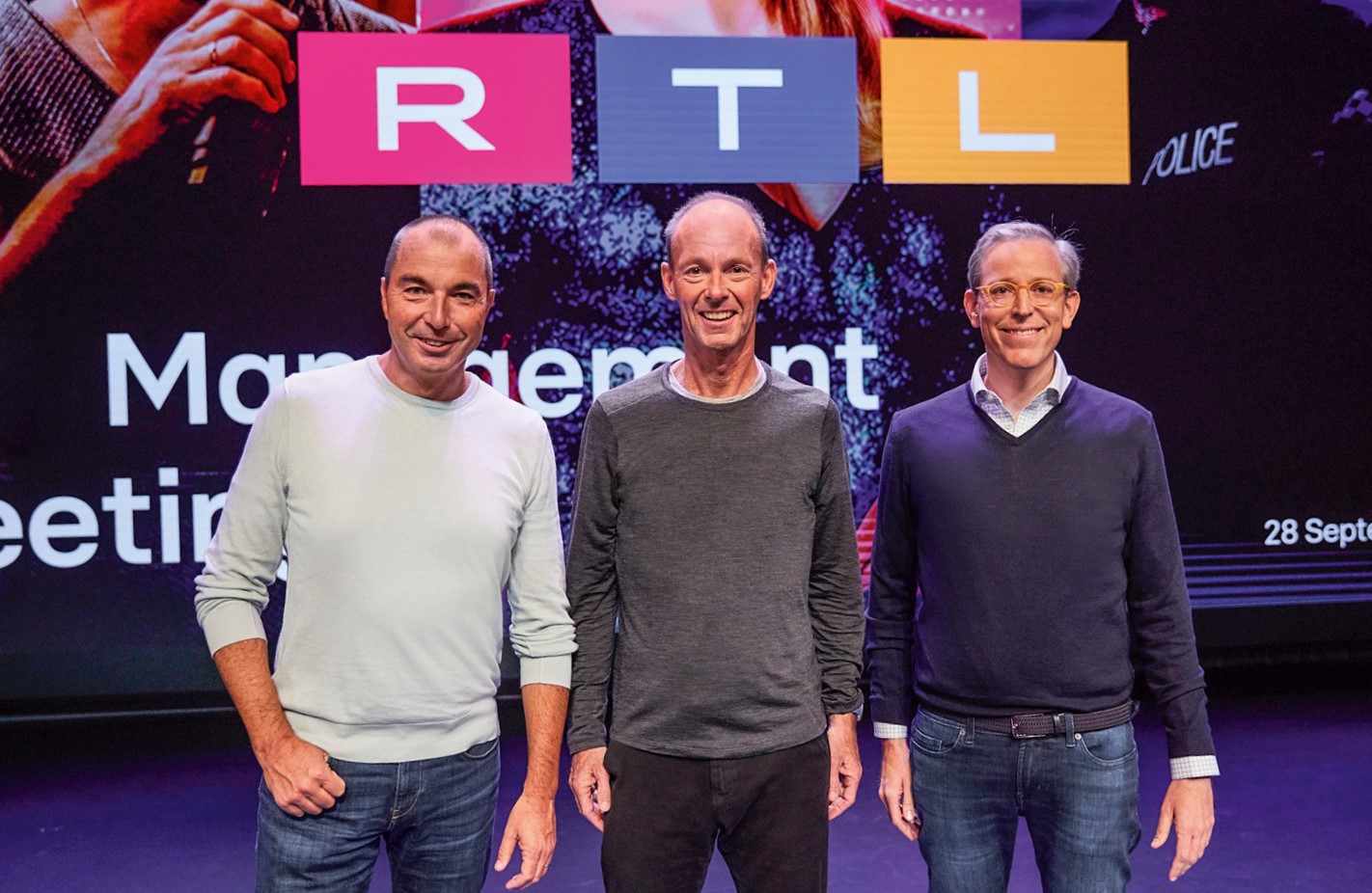

The RTL Management Meeting took place

in September 2022, uniting 130 executives

from across RTL Group. Thomas Rabe shared

the stage with other presenters to discuss

topics related to strategy, diversity and

independent journalism.

By the end of 2022, we achieved a total of 5.5 million paying subscribers for RTL+ in Germany and Hungary, and Videoland in the Netherlands – representing an increase of 44 per cent year on year. Streaming revenue was up by 20 per cent to €267 million.

In Germany, we are gradually expanding our cross-media offer. In August 2022, RTL Deutschland launched the RTL+ Musik app. In addition to video content, RTL+ users now have access to more than 90 million songs. To achieve this, RTL+ entered into a partnership with Deezer, one of the world’s leading music streaming services, which is exclusive in the German market. Most recently, podcasts were added to RTL+ Musik, followed by a growing selection of audiobooks. Ultimately, we aim to bundle our entertainment offers in one multimedia app to provide to our customers a personalised, state-of-the-art experience.

In autumn, RTL Hungary introduced our unified RTL brand identity and launched a new streaming service, also called RTL+. The new service offers exclusive local content – a unique feature in the Hungarian streaming landscape – and is based on the technology of Bedrock, RTL Group’s streaming tech company. In the Netherlands, Videoland successfully finalised the migration of its subscribers to the Bedrock platform.

RTL is on track to reach its ambitious streaming targets. By 2026, we plan to double our annual content investments to around €600 million in comparison to 2022. On this basis, we aim to grow the number of paying subscribers for RTL+ and Videoland to 10 million by the end of 2026, to increase our streaming revenue to €1 billion, and to reach profitability in 2026.

One year ago, I wrote in this report that we also have big ambitions for Fremantle. We intend to accelerate the company’s expansion, both organically and via M&A, with a revenue target of €3 billion by 2025, thus doubling the revenue compared with 2020.

We have already made a big step towards this goal. In 2022, Fremantle’s revenue grew by 22 per cent to over €2.3 billion, or by 8 per cent organically. In total, Fremantle completed eight acquisitions and step-ups in 2022, in all major territories and across all genres – from the Italian high-quality fiction producer Lux Vide to the award-winning film and drama production company Element Pictures and documentary producers 72 Films and Wildstar Films. Working with world-class storytellers and being the partner of choice for international talent – such as Angelina Jolie, Richard Brown, Edward Berger and Salma Hayek Pinault – is key to the success of Fremantle.

Fremantle has become an even stronger, more creative, more diverse global content powerhouse – both in terms of geographic footprint and output across entertainment, drama and film, and documentaries. While continuing to look for acquisitions and partnerships, we will increasingly focus on the integration of the acquired companies in the Fremantle network and on lifting the margins.

Thomas Rabe and his Executive

Committee colleagues, Deputy CEO &

COO Elmar Heggen (left) and

CFO Björn Bauer (right), at the RTL

Management Meeting 2022.

Over the past years, we have transformed the portfolio of RTL Group. We have divested a series of smaller and non-core assets with significant capital gains, boosted Fremantle and built national streaming champions with RTL+ and Videoland. Unfortunately, we did not succeed with two larger consolidation moves for our broadcasting businesses in France and the Netherlands: the planned combinations of Groupe TF1 and Groupe M6 and of RTL Nederland and Talpa Network. In both countries, the competition authorities did not take into account the speed and extent of the changes in the European media landscape and the impact of these changes on local media companies.

Above all, we see these as missed opportunities for us and the European media industry. RTL Group remains convinced that market consolidation is necessary to compete with the global tech platforms – and that market consolidation will happen in the European TV markets sooner or later. Thus, we remain committed to scaling up our TV and streaming businesses. There are other ways to scale, but they take longer: smaller acquisitions and partnerships across advertising sales, advertising and streaming technology, content creation, distribution and data.

In order to further strengthen RTL Deutschland’s leading position and journalistic relevance in Germany, we thoroughly reviewed the publishing business which we acquired at the beginning of 2022. The current macroeconomic environment puts the publishing business under particular pressure, with decreasing advertising and circulation revenue, and higher costs for energy and paper. We thus decided to focus on core brands such as Stern, Geo, Capital, Brigitte and Gala. By 2025, we will invest around €80 million in their transformation, primarily in paid digital content and services. The combination of RTL Deutschland’s TV, streaming and publishing businesses creates value in the form of synergies of around €75 million annually, in such areas as content creation, advertising sales, tech & data and corporate functions.

The international media industry is currently in the middle of a major transformation. This causes significant challenges and tough decisions – but also presents huge opportunities. RTL Group has the creativity, flexibility and investment capacity to future-proof our core business and take advantage of growth areas such as streaming, content production and advertising technology. With our strong financial position and clear strategy, I am confident that we will continue to prosper as Europe’s leading entertainment company.