Selected chapters from the RTL Group Directors’ Report can be found here in digital form.

The complete Annual Report 2022 can be found here as a PDF flip catalogue.

RTL Group analyses key performance indicators (KPIs) to manage its businesses, including revenue, organic growth/decline, Adjusted EBITA, Adjusted EBITA before streaming start-up losses, Adjusted EBITA margin, net debt, operating cash conversion rate and audience shares in the company’s main target groups. RTL Group’s key performance indicators are mostly determined on the basis of so-called alternative performance measures, which are not defined by IFRS. Management believes they are relevant for measuring the performance of the Group’s operations, financial position and cash flows, and for making decisions. These KPIs also provide additional information for users of the financial statements regarding the management of the Group on a consistent basis over time and regularity of reporting. These should not be considered in isolation but as complementary information for evaluating the Group’s business situation. RTL Group’s KPIs may not be comparable to similarly titled measures reported by other groups due to differences in the way these measures are calculated.

Organic growth is calculated by adjusting the reported revenue growth mainly for the impact of exchange rate effects, corporate acquisitions and disposals. It should be seen as a component of the reported revenue shown in the income statement. Its main objective is for the reader to isolate the impacts of portfolio changes and exchange rates on the reported revenue. When determining the exchange rate effects, the functional currency that is valid in the respective country is used. Potential other effects may include changes in methods and reporting.

EBIT, Adjusted EBITA and EBITDA are indicators of operating profitability. With significant investments in the Group’s streaming activities, RTL Group additionally use Adjusted EBITA before streaming start-up losses. The key performance indicator for the operating profitability of RTL Group and its business units is Adjusted EBITA. Analysts also continue to use EBITDA as a KPI for the Group’s profitability. As a result, for these purposes the calculation of EBITDA for the Group is also disclosed.

RTL Group comments primarily on Adjusted EBITA as the KPI for measuring profitability.

Adjusted EBITA represents a recurring operating result and excludes significant special items. RTL Group management has established an ‘Adjusted EBITA’ that neutralises the impacts of structural distortions for the sake of transparency. Based on the accelerated industry trends explained in the Market section (pages 48 to 49) and Strategy section (pages 50 to 54) in this Directors’ report, RTL Group plans to increase its investments in business transformation including streaming, premium content, technology and data. At the same time, management continually assess opportunities to reduce costs in the Group’s traditional broadcasting activities – for example, reallocating resources from its traditional businesses to its growing digital businesses – and this may lead to restructuring expenses that are neutralised in the Adjusted EBITA.

Adjusted EBITA is determined as earnings before interest and taxes (EBIT) as disclosed in the income statement excluding the following elements:

Significant special items exceeding the cumulative threshold of €5 million need to be approved by management, and primarily consist of restructuring expenses or reversal of restructuring provisions and other special factors or distortions. The adjustments for special items serve to determine a sustainable operating result that could be repeated under normal economic circumstances and is not affected by special factors or structural distortions. In 2022, ‘Significant special items’ reflects restructuring and integration costs in Germany (€–33 million) following the Gruner + Jahr transaction as well as the impact of expenses in connection with strategic portfolio management (€–11 million). In 2021 ‘Significant special items’ reflected the impact of restructuring expenses at RTL Deutschland (€–38 million), reversal of negative effects from onerous advertising sales contracts (€10 million) and the impact of expenses in connection with strategic portfolio management (€–33 million).

| 2022 €m | 2021 €m | |

| Earnings before interest and taxes (EBIT) | 987 | 1,908 |

| Impairment of goodwill of subsidiaries | – | – |

| Amortisation and impairment of fair value adjustments on acquisitions of subsidiaries | 46 | 19 |

| Impairment and reversals of investments accounted for using the equity method | 5 | (2) |

| Impairment and reversals on other financial assets at amortised cost | 30 | – |

| Re-measurement of earn-out arrangements | – | – |

| Fair value measurement of investments | 78 | 115 |

| (Gain)/loss from sale of subsidiaries, other investments and re-measurement to fair value of pre-existing interest in acquiree | (107) | (949) |

| EBITA | 1,039 | 1,091 |

| Significant special items | 44 | 61 |

| Adjusted EBITA | 1,083 | 1,152 |

In accordance with RTL Group’s strategy, the company continued to invest heavily in its streaming services, RTL+ in Germany and Hungary and Videoland in the Netherlands, all of which have seen a rapid increase in the number of paying subscribers (for further details please refer to Building national streaming champions on page 52). The Adjusted EBITA of RTL Group is impacted by effects relating to the growth of its streaming services. These are operational in nature, and are not included in ‘Significant special items’. RTL Group believes the disclosure of ‘streaming start-up losses’ and ‘Adjusted EBITA before streaming start-up losses’ provide important context for its business performance, hence it discloses information relating to both KPIs in addition to its leading alternative performance measure, ‘Adjusted EBITA’. Streaming start-up losses are defined as a total of Adjusted EBITA from RTL+ in Germany and Hungary, Videoland/RTL XL, Salto and Bedrock as consolidated on RTL Group level. For the year 2022, the total of streaming start-up losses amounted to €233 million (2021: €166 million). Adjusted EBITA before streaming start-up losses was €1,316 million (2021: €1,318 million).

The Adjusted EBITA margin as a percentage of Adjusted EBITA of revenue is used as an additional criteria for assessing business performance.

EBITDA represents earnings before interest and taxes (EBIT) excluding some elements of the income statement:

| 2022 €m | 2021 €m | |

| Earnings before interest and taxes (EBIT) | 987 | 1,908 |

| Depreciation, amortisation and impairment | 240 | 209 |

| Impairment of goodwill of subsidiaries | – | – |

| Amortisation and impairment of fair value adjustments on acquisitions of subsidiaries | 46 | 19 |

| Impairment and reversals of investments accounted for using the equity method | 5 | (2) |

| Impairment and reversals on other financial assets at amortised cost | 30 | – |

| Re-measurement of earn-out arrangements | – | – |

| Fair value measurement of investments | 78 | 115 |

| (Gain)/loss from sale of subsidiaries, other investments and re-measurement to fair value of pre-existing interest in acquiree | (107) | (949) |

| EBITDA | 1,279 | 1,300 |

The operating cash conversion rate (OCC) reflects the level of operating profits converted into cash available for investors after incorporation of the minimum investments required to sustain the current profitability of the business and before reimbursement of funded debts (interest included) and payment of income taxes. The operating cash conversion rate of RTL Group’s operations is subject to seasonality and investment cycles. RTL Group historically had – and expects in the future to have – a strong OCC due to a high focus on working capital and capital expenditure throughout the Group’s operations. OCC should be above 90 per cent in the long-term average and/or it should normally exceed market benchmarks in a given year.

OCC means operating free cash flow divided by EBITA – operating free cash flow being net cash from operating activities adjusted by the following elements:

| 2022 €m | 2021 €m | |

| Net cash from operating activities | 463 | 932 |

| Adjusted by: | ||

| Income tax paid | 293 | 437 |

| Transaction-related costs | 9 | 72 |

| Acquisitions of: | ||

| Programme and other rights | (68) | (88) |

| Other intangible and tangible assets | (133) | (107) |

| Proceeds from the sale of intangible and tangible assets | 1 | 2 |

| Operating free cash flow | 565 | 1,248 |

| EBITA | 1,039 | 1,091 |

| Operating cash conversion rate | 54% | 114% |

The net cash/(debt) is the gross balance sheet financial debt adjusted for:

In order to assess RTL Group’s leverage, the net debt to EBITDA ratio is used. The ratio is calculated as net debt divided by EBITDA.

| 31 December 2022 €m | 31 December 2021 €m | |

| Current loans and bank overdrafts | (547) | (49) |

| Non-current loans | (138) | (635) |

| (685) | (684) | |

| Deduction of: | ||

| Cash and cash equivalents | 589 | 547 |

| Current deposits with shareholder and its subsidiaries | 276 | 794 |

| Net cash/(debt) | 180 | 657 |

| EBITDA | 1,279 | 1,300 |

| Net cash/(debt) to EBITDA ratio | n.a. | n.a. |

The net debt excludes current and non-current lease liabilities of €385 million (31 December 2021: €332 million).

Operating cost base is calculated as the sum of ‘Consumption of current programme rights’, ‘Depreciation, amortisation, and impairment’ and ‘Other operating expenses’.

| 2022 €m | 2021 €m | |

| Consumption of current programme rights | 2,894 | 2,512 |

| Depreciation, amortisation and impairment | 240 | 209 |

| Other operating expenses | 3,257 | 3,055 |

| Operating cost base | 6,391 | 5,776 |

Dividend payout ratio means the absolute dividend amount divided by the adjusted profit attributable to RTL Group shareholders.

The absolute dividend amount is based on the number of issued ordinary shares at 31 December, multiplied by the dividend per share. The main adjustments on profit attributable to RTL Group shareholders refer to SpotX, Super RTL, Stéphane Plaza Immobilier, Eureka and VideoAmp.

| 2022 €m | |

| Profit attributable to RTL Group shareholders | 673 |

| Dividend policy adjustments | 13 |

| Adjusted profit for the year attributable to RTL Group shareholders | 660 |

| from ordinary activities | 552 |

| from cash capital gains (from RTL Belgium and RTL Croatia transactions) | 109 |

| Dividend in € per share | 4.00 |

| from ordinary activities | 3.50 |

| from cash capital gains (from RTL Belgium and RTL Croatia transactions) | 0.50 |

| Dividend, absolute amount | 619 |

| Dividend payout ratio1 | 94% |

| 1 Dividend, absolute amount/adjusted profit attributable to RTL Group shareholders | |

RTL Group estimates that the net TV advertising markets were down in Germany and France, while increasing in the Netherlands and Hungary. A summary of RTL Group’s key markets is shown below, including estimates of net TV advertising market growth rates and the audience shares in the main target audience group.

| Estimated net TV advertising market growth rate 2022 (in per cent) | RTL Group audience share in the main target group 2022 (in per cent) | RTL Group audience share in the main target group 2021 (in per cent) | |

| Germany | –8.0 to –9.01 | 26.82 | 26.32 |

| France | –23 | 22.34 | 22.84 |

| The Netherlands | +8.71 | 34.75 | 34.25 |

| Hungary | +3.61 | 28.96 | 30.56 |

1 Industry and RTL Group estimates

2 Source: GfK. Target group: 14−59, including pay TV channels

3 Source: Groupe M6 estimate

4 Source: Médiamétrie. Target group: women under 50 responsible for purchases (free-to-air channels: M6, W9, 6ter and Gulli)

5 Source: SKO. Target group: 25−54, 18−24h

6 Source: AGB Hungary. Target group: 18−49, prime time; RTL Hungary has changed the publication of its audience figures as of 2022 and is now using ’Linear SHR’ audience share data calculated without the category ‘Other’ of Nielsen | |||

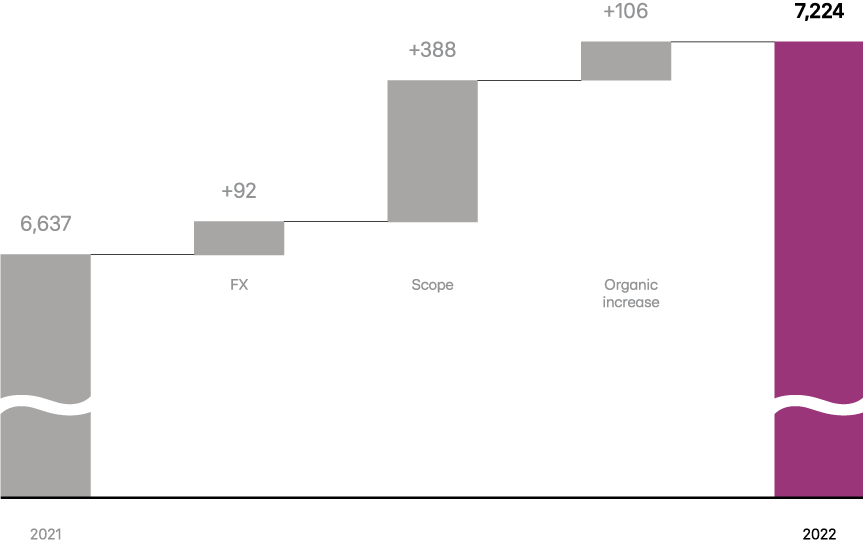

Group revenue increased 8.8 per cent to €7,224 million (2021: €6,637 million), mainly thanks to strong growth of Fremantle, RTL Deutschland (from the acquisitions of Gruner + Jahr in 2022 and Super RTL in 2021) and RTL Nederland. Group revenue was up 1.6 per cent organically7 compared to 2021, driven by Fremantle and RTL Nederland.

7 Adjusted for portfolio changes and at constant exchange rates. Further details can be found in Key performance indicators on page 58

(in € million)

Streaming revenue – which includes SVOD, TVOD, in-stream and distribution revenue from RTL+ in Germany and Hungary and Videoland/RTL XL in the Netherlands – was up by 19.7 per cent, to €267 million (2021: €223 million), thanks to the rapidly growing number of paying subscribers.

RTL Group’s advertising revenue was €3,722 million (2021: €3,774 million), of which €2,923 million represented TV advertising revenue (2021: €3,057 million), €385 million represented digital advertising revenue (2021: €348 million) and €192 million represented radio advertising revenue (2021: €219 million).

RTL Group’s digital revenue was up by 13.9 per cent to €1,234 million (2021: €1,083 million), mainly thanks to RTL Deutschland and Fremantle.

Distribution revenue8 – generated across all distribution platforms (cable, satellite, internet TV) including subscription and re-transmission fees – was stable at €438 million (2021: €437 million).

Digital revenue is spread over three different categories: digital advertising sales, revenue from distribution and licensing content, and consumer and professional services. In contrast to some competitors, RTL Group recognises only pure digital businesses as digital revenue and does not consider e-commerce, home shopping and distribution revenue as digital revenue. Revenue from e-commerce and home shopping is included in ‘revenue from selling goods and merchandise and providing services’ as stated in note 5.1 to the consolidated financial statements.

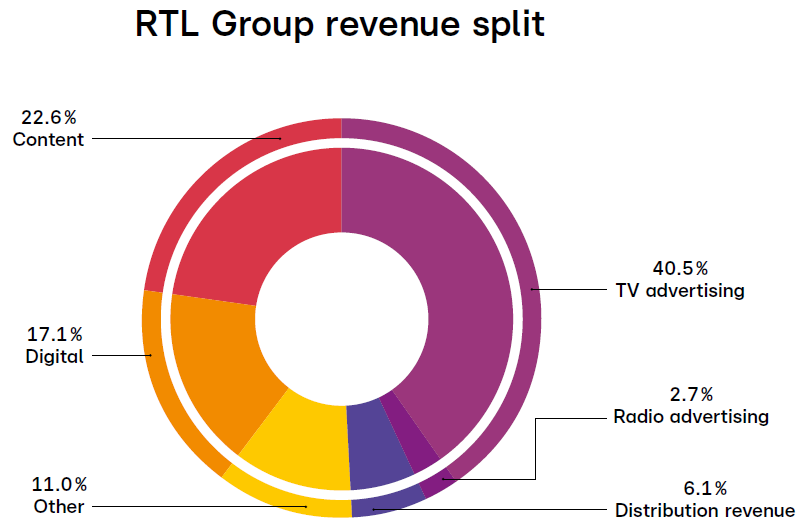

RTL Group’s revenue is well diversified, with 40.5 per cent from TV advertising, 22.6 per cent from content, 17.1 per cent from digital activities, 6.1 per cent from distribution revenue, 2.7 per cent from radio advertising, and 11.0 per cent from other revenue.

8 Revenue generated across all distribution platforms (cable, satellite, internet TV) including subscription and re-transmission fee

| 2022 € m | 2022 % | 2021 €m | 2021 % | |

| Germany | 2,606 | 36.1 | 2,241 | 33.8 |

| France | 1,367 | 18.9 | 1,392 | 21.0 |

| United States | 1,003 | 13.9 | 901 | 13.6 |

| The Netherlands | 628 | 8.7 | 610 | 9.2 |

| UK | 319 | 4.4 | 233 | 3.5 |

| Belgium | 72 | 1.0 | 203 | 3.1 |

| Other regions | 1,229 | 17.0 | 1,057 | 15.9 |

Adjusted EBITA1 was down by 6.0 per cent to €1,083 million (2021: €1,152 million), due to RTL Deutschland (with higher streaming start-up losses and lower TV advertising revenue), the scope exit of RTL Belgium, and Groupe M6. These effects were partly offset by record Adjusted EBITA contributions from RTL Nederland and Fremantle.

The Adjusted EBITA margin1 decreased to 15.0 per cent (2021: 17.4 per cent) as streaming start-up losses1 increased to €233 million (2021: €166 million).

For more detailed information and reconciliation of these measures see pages 58 to 59.

1See Key performance indicators on pages 58 to 59| 2022 € m | 2021 €m | 2020 €m | 2019 €m | 2018 €m | |

| Revenue | 7,224 | 6,637 | 6,017 | 6,651 | 6,505 |

| Adjusted EBITA | 1,083 | 1,152 | 853 | 1,156 | 1,171 |

| Net cash/(debt) | 180 | 657 | 236 | (384) | (470) |

| Operating cash conversion rate (in per cent) | 54 | 114 | 123 | 105 | 90 |

Group operating cost base increased to €6,391 million in 2022 (2021: €5,776 million), mainly due to increased programme costs at the Group’s broadcasting businesses, production costs at Fremantle and scope effects mainly relating to the acquisition of Gruner + Jahr.

The total share of results of these investments decreased to €14 million (2021: €27 million), mainly due to declined results of underlying companies and changes in the consolidation method of Super RTL and Stéphane Plaza Immobilier. Furthermore, the Group experienced a negative impact from its share of net losses from Salto in 2022, which amounted to €–18 million. Cumulative losses of Salto since inception in excess of the value of the Group's investment were recognised as an impairment amount of €–28 million to the provided loan and an excess of €–15 million as a provision.

Fair value measurement of investments of €–78 million (2021: €–115 million) is mostly attributable to the negative valuation effects of the Magnite shares held by RTL Group.

In 2022, the Group recorded a gain of €107 million (2021: €949 million), mainly thanks to the disposals of RTL Belgium and RTL Croatia. In 2021, the gain was mainly thanks to the disposals of SpotX and Ludia and positive effects in re-measurement of pre-existing interests in Super RTL and Stéphane Plaza Immobilier.

Financial result amounted to the expense of €–55 million (2021: €–27 million). The comprehensive description on the financial result is disclosed in the notes 5.4 and 5.5 to the consolidated financial statements.

The Group has conducted impairment testing on the different cash-generating units (see note 6.2 to the consolidated financial statements).

The loss, totalling €–46 million (2021: €–19 million), relates to the amortisation of fair value adjustments on acquisitions of subsidiaries.

In 2022, the income tax expense was €–166 million (2021: €–427 million), due to lower profit before tax mainly resulting from a decrease of taxable capital gains compared to 2021.

The profit for the year attributable to RTL Group shareholders was €673 million (2021: €1,301 million). The profit in 2021 was extraordinarily high mainly thanks to the capital gains of the disposals of SpotX and Ludia, positive effects of pre-existing interests in Super RTL and Stéphane Plaza Immobilier, and higher Adjusted EBITA.

Earnings per share, based upon 154,742,806 weighted average number of ordinary shares, both basic and diluted, was €4.35 (2021: €8.41 per share based on 154,742,806 shares).

RTL Group has an issued share capital of €154,742,806 divided into 154,742,806 fully paid-up shares with no defined par value.

Since 31 December 2020, the Group no longer holds treasury shares.

The annual accounts of RTL Group show a profit for the financial year 2022 of €104,596,391 (2021: €70,963,534). Taking into account the share premium account of €4,167,138,981 (2021: €4,691,802,190) and the profit brought forward of €70,963,534 (2021: €249,050,821), the amount available for distribution is €4,342,698,906 (2021: €5,011,816,545).

In January 2022, RTL Deutschland GmbH acquired 100 per cent of the share capital of Gruner + Jahr Deutschland GmbH and, on 1 April 2022, 50 per cent of Deutsche Medien Manufaktur (DMM). These acquisitions were preceded by RTL Group’s decision in August 2021 to acquire Gruner + Jahr’s German publishing assets and brands from Bertelsmann to create a German cross-media champion across TV, streaming, print, radio and digital. The final purchase price amounted to €228 million, of which €210 million was pre-paid in 2021.

In January 2022, RTL Group sold its entire investment in VideoAmp – a US software and data company for media measurement – for US-$ 104 million (€92 million) in cash. The transaction was carried out as a share buyback by VideoAmp.

In March 2022, Fremantle acquired 70 per cent of the shareholding in the leading Italian scripted production company, Lux Vide, for €43 million.

In March 2022, RTL Group closed the sale of RTL Belgium to the Belgian media companies DPG Media and Groupe Rossel, resulting in net cash inflows of €154 million.

In April 2022, Fremantle increased its stake in Dancing Ledge Productions from 25 per cent to 61 per cent for €6 million. The UK-based production company is behind drama series such as The Responder and The Salisbury Poisonings.

In May 2022, Fremantle acquired 51 per cent of Element Pictures, the production company behind Academy Award, Golden Globe and BAFTA-winning films The Favourite and Room, the global drama Normal People, and the mini-series Conversations With Friends. The consideration transferred amounted to €56 million and comprises a purchase price payment already made in the amount of €46 million and a contingent consideration in the amount of €10 million.

In May 2022, RTL Group’s European ad-tech business, Smartclip, fully acquired the French ad-tech company Realytics for €7 million.

In June 2022, RTL Group sold RTL Croatia to Central European Media Enterprises (CME). The total consideration amounts to €41 million net of cash disposed and is subject to customary adjustments. In addition, RTL Group has agreed to a long-term trademark licensing agreement with the buyer.

In June 2022, Fremantle fully acquired Eureka for an additional US-$ 55 million (€55 million) after taking a majority stake of 51 per cent in 2021.

In November 2022, Fremantle acquired a 55 per cent stake in 72 Films for €51 million, of which €44 million was paid in cash. In the same month, Fremantle also acquired a 51 per cent stake in Wildstar Films for €19 million, of which €13 million was paid in cash.

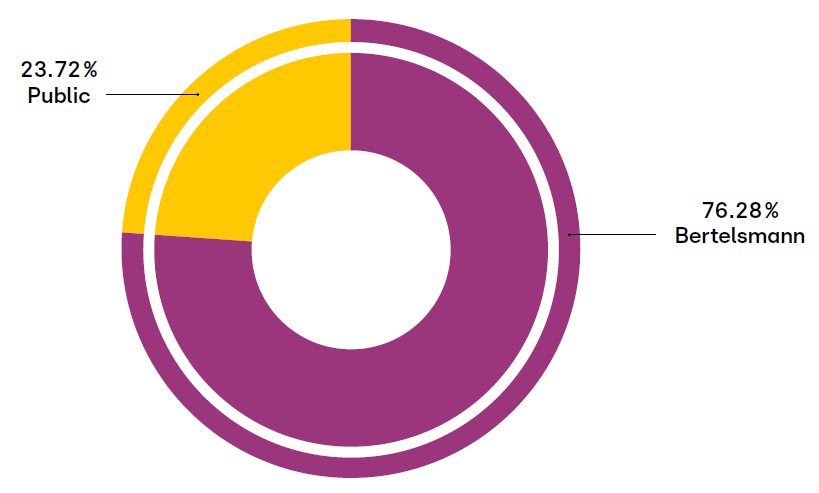

At 31 December 2022, the principal shareholder of the Group is Bertelsmann Capital Holding GmbH (BCH) (76.28 per cent). The remainder of the Group’s shares are publicly listed on the Frankfurt and Luxembourg Stock Exchanges. The ultimate parent company of RTL Group SA, Bertelsmann SE & Co KGaA, includes in its consolidated financial statements those of RTL Group SA.

The Group also has a related party relationship with its associates, joint ventures, directors and executive officers.

The comprehensive description on the related party transactions is disclosed in note 10 to the consolidated financial statements.

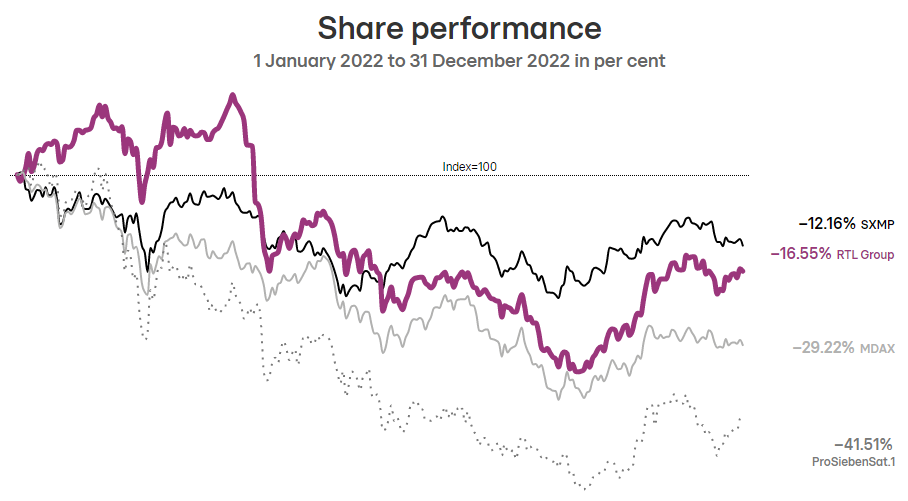

RTL Group’s shares (ISIN: LU0061462528) are publicly traded on the regulated market (Prime Standard) of the Frankfurt Stock Exchange and the Luxembourg Stock Exchange. RTL Group is listed in the MDAX stock index.

1 January 2022 to 31 December 2022 in per cent

RTL Group’s share price started 2022 at €47.26 and finished the year down 16.6 per cent, at €39.44, thereby outperforming the German index MDAX. The share price highs and lows were €53.75 (21 April) and €31.28 (10 October).

Quarterly, the average share price evolved as follows:

Q1: €49.80

Q2: €44.90

Q3: €37.03

Q4: €36.66

The Group declared a dividend in April 2022 that was paid on 5 May 2022. The payment of €5.00 (gross) per share related to the 2021 full-year dividend. The total dividend paid amounted to €774 million. Based on the average share price in 2021 (€48.60), this represented a dividend yield of 10.3 per cent (2021: 8.9 per cent) and a dividend payout ratio of around 80 per cent, in line with the Group’s dividend policy.

For more information on the analysts’ views on RTL Group and RTL Group’s equity story, please visit the Investor Relations section on rtl.com.

In 2019, RTL Group decided to cancel its ratings from both S&P and Moody’s. Until the date of the cancellation, these ratings were fully aligned to RTL Group’s parent company, Bertelsmann SE & Co KGaA, due to its shareholding level and control of RTL Group.

RTL Group’s dividend policy offers a payout ratio of at least 80 per cent of the Group’s adjusted net result.

The adjusted net result is the reported net result available to RTL Group shareholders, adjusted for any material non-cash impacts, such as goodwill impairments.

The share capital of the company is set at €191,845,074, divided into 154,742,806 shares with no par value.

The shares are in the form of either registered or bearer shares, at the option of the owner.

Bertelsmann has been the majority shareholder of RTL Group since July 2001. As at 31 December 2022, Bertelsmann held 76.28 per cent of RTL Group shares, and 23.72 per cent were free float.

There is no obligation for a shareholder to inform the company of any transfer of bearer shares save for the obligations provided by the Luxembourg law of 15 January 2008 on transparency requirements in relation to information about issuers whose securities are admitted to trading on a regulated market. Accordingly, the company shall not be liable for the accuracy or completeness of the information shown.

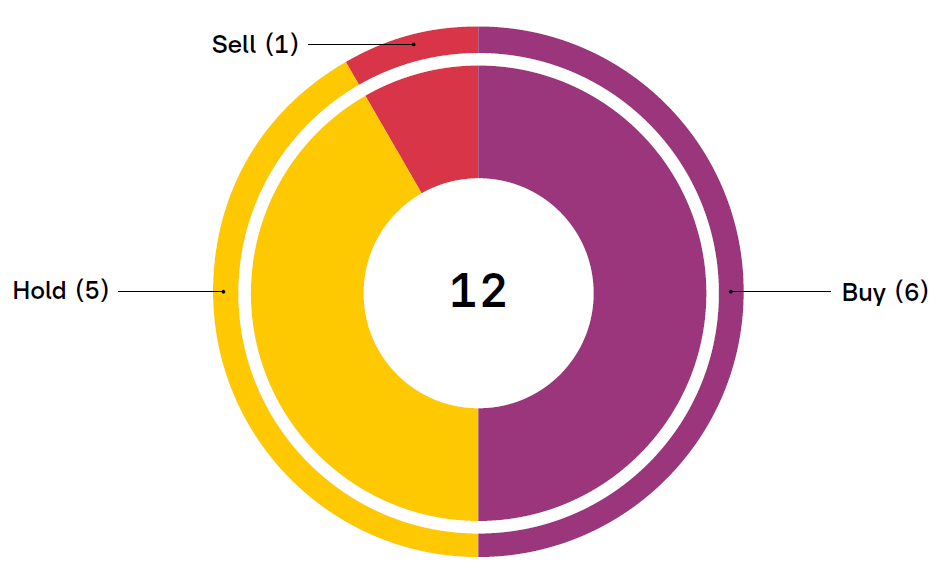

as at 31 December 2022

1 Based on analyst coverage as at 31 December 2022

| ISIN | LU0061462528 |

|---|---|

| Exchange symbol | RRTL |

| WKN | 861149 |

| Share type | Ordinary |

| Bloomberg code | RRTL:GR |

| Reuters code | RRTL |

| Ticker | RRTL |

| Transparency level on first quotation | Prime Standard |

| Market segment | Regulated Market |

| Trading model | Continuous Trading |

| Sector | Media |

| Stock exchanges | Frankfurt, Luxembourg |

| Last total dividend (for financial year 2021) | € 5.00 |

| Number of shares | 154,742,806 |

| Market capitalisation1 | € 6,103,056,269 |

| 52 week high | € 53.75 (21 April 2022) |

| 52 week low | € 31.28 (10 October 2022) |

| 1 As of 31 December 2022 |

RTL Group’s shares were/are listed in the indices with the weight as outlined below:

| Index | Weight in per cent | Date |

| MDAX | 0.9970 | 30/12/2022 |

| MDAX Kursindex | 0.9972 | 30/12/2022 |

| Prime All Share | 0.0971 | 30/12/2022 |

| HDAX | 0.1038 | 30/12/2022 |

| HDAX Kursindex | 0.1039 | 30/12/2022 |

The geopolitical and macroeconomic environment remains volatile and the impact on RTL Group’s businesses is hard to predict.

On this basis and subject to the above:

| 2022 | 2023e | |

| Revenue | € 7,224m | €7.3bn to €7.4bn |

| Adjusted EBITA | € 1,083m | €1.0bn to €1.05bn |

| Streaming start-up losses | € 233m | Just below €0.2bn |

| Adjusted EBITA before streaming start-up losses | € 1,316m | €1.2bn to €1.25bn |

| 2022 | 2026e | |

| Paying subscribers | 5.5m | 10m |

| Streaming revenue | € 267m | €1bn |

| Content spend per annum | € 304m | ~€600m |

Profitability is expected by 20262.

1 RTL+ in Germany and Hungary and Videoland in the Netherlands

2 Total of Adjusted EBITA from RTL+, Videoland/RTL XL, Salto and Bedrock as consolidated on RTL Group level. The Adjusted EBITA of RTL+ in Germany and Hungary and Videoland/RTL XL in the Netherlands includes synergies with TV channels at business unit level. For the definition of Adjusted EBITA please see Key performance indicators on pages 58 to 59

Fremantle targets full-year revenue of €3 billion by 2025.

To reach this goal and keep up with the increasing demand for content, RTL Group will invest significantly in Fremantle – both organically and via acquisitions – in all territories across drama and film, entertainment and factual shows and documentaries.

| Revenue | 2022 €m | 2021 €m | Per cent change |

| RTL Deutschland | 2,766 | 2,425 | +14.1 |

| Groupe M6 | 1,357 | 1,390 | (2.4) |

| Fremantle | 2,347 | 1,926 | +21.9 |

| RTL Nederland | 636 | 575 | +10.6 |

| Other segments | 411 | 604 | (32.0) |

| Eliminations | (293) | (283) | |

| Total revenue | 7,224 | 6,637 | +8.8 |

| Adjusted EBITA | 2022 €m | 2021 €m | Per cent change |

| RTL Deutschland | 459 | 541 | (15.2) |

| Groupe M6 | 304 | 329 | (7.6) |

| Fremantle | 162 | 141 | +14.9 |

| RTL Nederland | 161 | 107 | +50.5 |

| Other segments | (12) | 33 | <100.0 |

| Eliminations | 9 | 1 | |

| Adjusted EBITA | 1,083 | 1,152 | (6.0) |

| Adjusted EBITA margin | 2022 per cent | 2021 per cent | Percentage point change |

| RTL Deutschland | 16.6 | 22.3 | (5.7) |

| Groupe M6 | 22.4 | 23.7 | (1.3) |

| Fremantle | 6.9 | 7.3 | (0.4) |

| RTL Nederland | 25.3 | 18.6 | +6.7 |

| RTL Group | 15.0 | 17.4 | (2.4) |

In the reporting period, the German net TV advertising market was estimated to be down between 8.0 and 9.0 per cent with RTL Deutschland performing in line with the market. Total revenue of RTL Deutschland was up 14.1 per cent to €2,766 million (2021: €2,425 million), driven by the acquisitions of Gruner + Jahr in 2022 and Super RTL in 2021, as well as the German streaming service RTL+, partly offset by lower TV advertising revenue. Adjusted EBITA was down 15.2 per cent to €459 million (2021: €541 million), mainly due to higher streaming start-up losses and lower TV advertising revenue. This was partly offset by the reversal of provisions of €35 million relating to the legal proceeding with RTL 2 Fernsehen GmbH & Co KG and its sales house El Cartel GmbH & Co KG. With a decreasing print advertising market and increased prices for energy and paper, the acquired publishing business from Gruner + Jahr did not contribute notably to RTL Deutschland’s Adjusted EBITA.

In 2022, the combined average audience share of RTL Deutschland in the target group of viewers aged 14 to 59 was 26.8 per cent (2021: 26.3 per cent), including the pay-TV channels RTL Crime, RTL Living, RTL Passion and Geo Television. The German RTL family of channels increased its lead over its main commercial competitor, ProSiebenSat1, to 4.5 percentage points (audience share 2022: 22.3 per cent, lead up 1.0 percentage point compared to the previous year).

With its portfolio of eight free-TV channels, four pay-TV channels and the streaming service RTL+, RTL Deutschland reached 27.9 million viewers every day in 2022 (2021: 29.2 million).

With an audience share of 9.1 per cent (up 0.1 percentage points) in the target group of viewers aged 14 to 59 in 2022 (2021: 9.0 per cent), the German main channel RTL was the leading commercial channel, ahead of Sat1 (6.5 per cent), Vox (6.2 per cent) and ProSieben (5.8 per cent), but behind the public channels ZDF (9.3 per cent) and Das Erste (9.1 per cent).

Ich bin ein Star – Holt mich hier raus! (I’m a Celebrity – Get Me Out of Here!) was the channel’s most successful show in 2022. On average, 4.37 million total viewers (19.5 per cent) watched the 15th season, representing an average audience share of 26.0 per cent in the commercial target group of viewers aged 14 to 59. Let’s Dance generated the best audience share since 2016, scoring an average of 17.8 per cent in the commercial target group (2021: 17.5 per cent). The most-watched programme on RTL was the Europa League final of Eintracht Frankfurt vs. Glasgow Rangers on 18 May, which attracted an average of 9.1 million total viewers and a total audience share of 38.9 per cent. Three Uefa Nations League matches with the German National team also scored high audience shares. The late-night news show RTL Direkt scored an average audience share of 8.4 per cent in the commercial target group of viewers aged 14 to 59, putting it on par with the established news shows from the public broadcasters, Heute Journal and Tagesthemen. The extension of print brands to TV started well with the new TV magazine Gala (average audience share of 8.5 per cent) and the new weekly format Stern TV am Sonntag (7.2 per cent). In access primetime the daily series Gute Zeiten, schlechte Zeiten continued to generate a high audience share and attracted 13.7 per cent of viewers aged 14 to 59 (2021: 13.7 per cent).

The streaming service RTL+ continued its rapid growth in 2022 reaching 4.016 million paying subscribers – an increase of 48.1 per cent (2021: 2.712 million). Viewing time increased by 28 per cent year-on-year, making RTL+ the leading German entertainment offering in the streaming market. This was thanks to the wide range of programmes available, including reality TV shows such as Temptation Island VIP, Das Sommerhaus der Stars and Der Bachelor, and fictional series such as Sisi, Der König von Palma and Der Schiffsarzt. The football matches Eintracht Frankfurt vs. Glasgow Rangers, OGC Nizza vs. 1. FC Köln and Borussia Dortmund vs. Glasgow Rangers also attracted large audiences. The most-watched original documentary was Bushido.

In 2022, Vox ranked third among the commercial channels with an average audience share of 6.2 per cent in the target group of viewers aged 14 to 59 (2021: 6.1 per cent) and 6.7 per cent in the target group of viewers aged 14 to 49 (2021: 6.7 per cent). The primetime show Die Höhle der Löwen (Dragons’ Den) remained popular, generating the best spring season ever with an average audience share of 12.0 per cent in the commercial target group of viewers aged 14 to 59, while Kitchen Impossible was watched by 10.3 per cent. Mälzer und Henssler liefern ab (8.2 per cent), Sing meinen Song (6.8 per cent), Goodbye Deutschland (6.6 per cent) and First Dates Hotel (6.6 per cent) were also successes for Vox in the target group. The documentary Zum Schwarzwälder Hirsch – Eine außergewöhnliche Küchencrew was the best format launch in 2022, attracting an audience share of 6.9 per cent in the same target group.

Nitro attracted 2.2 per cent of the 14 to 59 target group (2021: 2.2 per cent) and 3.0 per cent of its main target demographic of men aged 30 to 49 (2021: 2.9 per cent).

The news channel NTV scored a total audience share of 1.2 per cent and attracted 1.4 per cent of viewers aged 14 to 59 (2021: 1.1 per cent and 1.2 per cent). RTL and NTV have kept the public continuously informed about the war in Ukraine since the first Russian attack. Between 24 February and 25 March 2022 alone, the channels provided around 377 hours of information in 140 RTL and NTV specials, reaching more than 36 million people in Germany.

RTL Up, previously RTL Plus, attained a 1.9 per cent audience share in the target group aged 14 to 59 (2021: 1.8 per cent).

Vox Up generated an audience share of 0.6 per cent in the target group of viewers aged 14 to 59, up 0.2 percentage points compared to 2021.

Super RTL retained its leading position in the children’s segment in 2022, attracting an average audience share of 17.4 per cent in the target group of three to 13-year-olds between 06:00 and 20:15, including Toggo Plus (2021: 21.0 per cent), ahead of the public service broadcaster KiKA (15.9 per cent) and Disney (11.2 per cent).

In 2022, RTL Zwei’s market share remained stable at 3.7 per cent among 14 to 59-year-old viewers (2021: 3.7 per cent).

RTL Deutschland’s publishing business was impacted by the challenging market environment, mainly due to increased prices for paper and energy, increasing inflation and supply chain issues. Thanks to strong stories and cover motifs, Stern kept its market share1 in retail sales almost stable at 26.4 per cent (IVW2021: 27.0 per cent). Nevertheless, and as expected, Stern lost 6.5 per cent in total circulation in 2022 compared to 2021. Stern was able to reduce the decline in total sales by 1.2 percentage points compared to the previous year (IVW 2021: −7.7 per cent). The circulation of celebrity magazine, Gala, was down 3.3 per cent compared to 2021 and the circulation of business magazine, Capital, was down 2.6 per cent.

Following the combination of RTL Deutschland and Gruner + Jahr, RTL Deutschland continued to expand its brands cross-media. RTL Television successfully launched Stern TV am Sonntag and Gala, while Super RTL started a new edutainment magazine for children, Geolino TV. RTL Deutschland continued to invest in paid content and the digital expansion of its brands. With Chefkoch Plus, Europe’s biggest food platform now offers its users a paid premium subscription that includes smart cooking features and no advertising.

Radio consumption in Germany remained strong in 2022, reaching 74.5 per cent of Germans aged 14+ daily – with an average listening time of 249 minutes per day. RTL Group’s German radio portfolio reached 14 million Germans aged 14+ each day. 104.6 RTL maintained its market-leading position in the highly competitive Berlin/Brandenburg radio market in the target group of listeners aged 14 to 49. Many radio stations increased their reach year on year, including Radio Brocken (of 41.9 per cent among listeners aged 14 to 49), Antenne Niedersachen (up 14.4 per cent among listeners aged 14+) and RTL Radio Deutschland’s Hitradio (up 22.7 per cent among listeners aged 14+).

1 Competitive environment defined as Der Spiegel, Die Zeit, Focus and Stern

In 2022, the French net TV advertising market was estimated to be down 2 per cent compared to 2021, with Groupe M6 underperforming in the market. Groupe M6’s total revenue was slightly down by 2.4 per cent to €1,357 million (2021: €1,390 million). The decrease in revenue was mainly due to the decrease in advertising revenue, partly offset by the growth of non-advertising revenue. Accordingly, Groupe M6’s Adjusted EBITA was down 7.6 per cent to €304 million (2021: €329 million).

The audience share of the Groupe M6 family of free-to-air channels in the commercial target group (women under 50 responsible for purchases) reached 22.3 per cent (2021: 22.8 per cent). The total audience share was 13.5 per cent (2021: 14.3 per cent). On average, 23.0 million viewers watched Groupe M6’s free-to-air channels every day in 2022 (2021: 25.1 million).

Flagship channel M6 retained its status as the second most-watched channel in France in the commercial target group, with an average audience share of 14.1 per cent (2021: 14.7 per cent). Established entertainment brands such as L'Amour est dans le pré (Farmer Wants a Wife), Top Chef and La France a Un Incroyable Talent (Got Talent) continued to attract high audience shares. The channel also introduced new favourites such as Les Traîtres (The Traitors). M6’s news shows Le 1245 and Le 1945, and magazine formats such as Capital and Zone Interdite scored audience records in the commercial target group.

The advertising-financed streaming service 6play recorded 24.5 million active users in 2022 (2021: 28.5 million). The viewing time was 470 million hours (2021: 530 million).

W9 reached an average audience share of 3.6 per cent among women under 50 responsible for purchases (2021: 3.8 per cent), ranking second among the DTT channels in France in this target group. Reality series, sports, films, and magazines continued to score high ratings.

Among the new generation of DTT channels, 6ter remained the leader in the commercial target group for the fifth consecutive year, with an average audience share of 2.7 per cent (2020: 2.6 per cent).

With Gulli, Groupe M6 was the leader among the children’s target group (aged 4 to 10 years) during daytime (06:00 to 20:00), attracting an average audience share of 12.6 per cent (2021: 12.7 per cent). Every day, nearly 5 million viewers watch their favourite animated heroes, live-action series, games and documentaries, as well as fiction and films for the whole family.

In 2022, the RTL radio family of stations registered a consolidated audience share of 18.4 per cent among listeners aged 13 and older (2021: 18.2 per cent). Its flagship station RTL Radio was the leading commercial station in France and increased its average audience share to 12.8 per cent (2021: 12.5 per cent). The pop-rock station RTL 2 recorded an average audience share of 3.1 per cent (2021: 3.0 per cent), while Fun Radio registered an average audience share of 2.5 per cent (2021: 2.8 per cent).

Revenue at RTL Group’s content business, Fremantle, was up by 21.9 per cent to €2,347 million in 2022 (2021: €1,926 million), thanks to scope effects from acquisitions in 2021 and 2022, organic growth1 (up 7.8 per cent) and positive foreign exchange rate effects. Accordingly, Adjusted EBITA was up 14.9 per cent to €162 million (2021: €141 million).

2022 saw several successful global drama launches, including The King (Il Re), from The Apartment Pictures and Wildside which premiered in Italy on Sky Atlantic and became the highest-rated Sky original scripted launch of 2022. A second season has already been recommissioned. Lux Vide’s Don Matteo was the number three fiction show on Rai1 in 2022, with each episode ranking as Italy’s number one show of the day.

The crime drama series from Dancing Ledge Productions, The Responder, achieved an average total audience share of 21.2 per cent on BBC One in the UK, peaking with an audience of 7.5 million viewers, making it the BBC’s second most popular new drama in the first half of 2022. It has since been sold internationally to Disney+ and Canal+, and the second season has already been commissioned. The series This England, produced by Passenger, was 2022’s number one Sky Atlantic Original drama launch based on seven-day and 28-day viewing. The series has also sold to over 90 countries around the world.

Heartbreak High from Fremantle in Australia was a global hit for Netflix, spending three weeks in its global top ten TV shows and generating over 43 million hours of viewing while it was in the top ten. It charted in Netflix’s top ten TV shows in 46 territories, with highest rankings at number two in Australia and number three in New Zealand. The show has already been renewed for a second season.

Fremantle continued to boost its film business in 2022, with Miso Film’s Blasted achieving the number one spot in the global Netflix top ten list for most-watched non-English-language films. Over 8 million hours were viewed in its first week on Netflix, and it entered Netflix’s weekly top ten films in 41 territories. The Wildside film 7 Women and a Murder was the number one non-English language film globally over the Christmas period, generating 13 million hours of viewing and charting in 49 territories on Netflix. The Wonder from Element Pictures peaked as Netflix’s number three English-language film globally, charting in the top ten in 83 territories and generating 43 million hours of viewing while in the top ten.

American Idol returned for its fifth season on ABC and Hulu, and the 20th season overall. The season won an average total audience of 7.2 million viewers and an average total audience share of 10.4 per cent, making it ABC’s number one series of the 2021/22 season. Indian Idol launched its 11th series in September 2022, winning an average audience share of 2.4 per cent and performing 82 per cent above Sony TV’s primetime average audience share. In Sweden, season 18 of the local version of Idols on TV4 registered an average audience share of 27.2 per cent, consistently ranking as the number one show of the day in the commercial target group of viewers aged 15 to 64.

Fremantle’s hit format Got Talent was the number three entertainment show on M6 in France for 2022, with an average audience share of 27.3 per cent in the commercial target group. In the US, season 17 of America’s Got Talent was the highest-rated summer show of 2022 and NBC’s number two entertainment show of the 2021/22 season, averaging 7.7 million viewers representing an audience share of 12.5 per cent. After an on-screen break of ten years, Canada's Got Talent launched on CityTV and scored an average total audience share of 7.1 per cent, while the 15th season of Britain’s Got Talent returned to UK screens on ITV. The Thames-produced show attracted an average total audience share of 34.0 per cent and a peak audience of 8.2 million viewers, making it the UK’s number one entertainment show in the first half of 2022.

Established formats continued to perform well with Farmer Wants a Wife in the Netherlands – produced by Blue Circle – attracting an average total audience share of 48.6 per cent. In France, the show scored its highest ratings in five years, with an average audience share of 32.2 per cent in the commercial target group, up 66 per cent on the broadcaster’s primetime average. The Belgian show, Farmer Wants a Wife: Love is Blind, consistently ranked as the number one non-news show of the day on VTM, with an average total audience share of 20.1 per cent. In Germany, the 18th season of Farmer Wants a Wife scored an average audience share of 14 per cent in the commercial target group of viewers aged 14 to 59, consistently ranking as the non-news show of the day on RTL.

Naked‘s new show Snowflake Mountain – which premiered on Netflix in June 2022 – entered the daily top three in the US, Canada and Iceland and the daily top ten in 29 countries in its first ten days on Netflix.

Poland’s first season of the hit format The Masked Singer launched as TVN’s best overnight entertainment launch for four years. In the Netherlands, the fourth series of the format was consistently RTL 4’s number one show of the week and scored an average audience share of 35.8 per cent. In Norway, the third series finale achieved a staggering 81 per cent total audience share, nearly double NRK1’s primetime average.

Fremantle continued to grow its entertainment business with streaming services. In 2022, it delivered two series of the English-language version of Too Hot to Handle. The third season was Netflix’s global number one unscripted show for two weeks with 73 million hours viewed, and season 4 was a top ten show in 71 territories. The second season of the format in Brazil remained in Brazil’s daily top ten shows for two weeks, while the second season of the Spanish original format Love Never Lies reached Netflix’s Spanish top ten, with over 5 million hours watched in its first week.

Password made a comeback to US primetime in summer 2022, averaging 4.9 million viewers across its broadcast on NBC, up 58 per cent on NBC’s summer primetime average audience share. Password was also number one in the timeslot for every episode, and ranked as NBC’s number one game show of the season. Ufa’s Wer weiß denn sowas? (Who knows such things?) remained the best performing non-scripted format in German access primetime, with an average total audience share of 18.0 per cent. For the first time in Germany, Wer weiß denn sowas? delivered a 24-hour non-stop live quiz marathon – broadcast mainly on the Mediathek of the German public broadcaster ARD.

Original Production’s Phat Tuesdays three-part documentary launched on Amazon Prime in February 2022, reaching 2.1 million unique viewers and ranking in Amazon Prime's top ten TV shows in the US for three weeks. Lola Indigo, La niña, Fremantle Spain’s original documentary co-produced with Universal Music, launched in May 2022 and ranked in the top ten on Amazon Prime in Spain for 21 days, peaking at number two.

In the UK, Naked’s documentary Ghislaine, Prince Andrew and the Paedophile, which was broadcast on ITV, reached an average audience share of 20.6 per cent, exceeding ITV’s primetime average share for total viewers and ranking number one in its timeslot.

Planet Sex with Cara Delevingne launched on BBC Three as a boxset, with all episodes available on demand at the launch in December 2022. The series, produced by Naked and Cara Delevingne’s company Milkshake Productions, explores the unique human stories and ground-breaking research behind today’s biggest questions around human sexuality. In October 2022, the documentary series Kingdom of Dreams, made in collaboration with Misfits Entertainment, launched on Sky.

1 Adjusted for portfolio changes and at constant exchange rates. Further details can be found in Key performance indicators on page 58

In 2022, the Dutch net TV advertising market was estimated to be up by 8.7 per cent. RTL Nederland’s total revenue increased by 10.6 per cent to €636 million (2021: €575 million), mainly due to significantly higher TV advertising revenue. This resulted in an Adjusted EBITA of €161 million, up 50.5 per cent year on year (2021: €107 million).

In 2022, RTL Nederland’s family of channels grew its combined primetime audience share in the target group of viewers aged 25 to 54 to 34.7 per cent (2021: 34.2 per cent), thanks to a strong audience performance of the main channel RTL 4. As a result, RTL Nederland increased its lead over the public broadcaster – which broadcast the Winter Olympics and the Fifa Football World Cup – to 5.5 percentage points (audience share 2022: 29.2 per cent) and remained ahead of its main commercial competitor, Talpa TV (audience share 2022: 19.8 per cent).

RTL Nederland’s flagship channel, RTL 4, grew its average primetime audience share in the target group of shoppers aged 25 to 54 to 22.7 per cent (2021: 21.6 per cent). The channel continued to score very high audience shares in this target group with The Masked Singer (43.3 per cent), De Verraders (The Traitors) (37.2 per cent) and Kopen Zonder Kijken (Buying Blind) (34.0 per cent). De Verraders was developed by IDTV and RTL Creative Unit and has already been sold internationally to NBC in the US, BBC in the UK and M6 in France. Two other RTL Creative Unit productions, Ik Weet Er Alles Van (Ask me Anything) (27.5 per cent) and B&B Vol Liefde (B&B Full of Love) (24.4 per cent), scored even better ratings than the previous summer. The increase in audience share was also thanks to RTL 4’s current affairs programmes in early prime time with RTL Boulevard (32.0 per cent) and Editie NL (28.6 per cent). The main evening news show RTL Nieuws grew its average audience share in 2022 to 34.5 per cent (2021: 31.5 per cent).

RTL Nederland’s streaming service, Videoland, recorded subscriber growth of 11.8 per cent to 1.221 million paying subscribers at the end of 2022 (end of 2021: 1.092 million). Videoland’s growth was largely thanks to the original series Sleepers and Mocro Maffia, the documentary about the Dutch singer André Hazes, the fifth season of The Handmaid’s Tale and the Dutch kickboxing live events of the Glory series, all of which are exclusive to Videoland in the Netherlands. In 2022, all users of Videoland were successfully migrated to the technical streaming platform provided by RTL Group’s streaming technology company, Bedrock.

RTL 5’s primetime audience share was 4.7 per cent in the target group of viewers aged 25 to 54 (2021: 4.1 per cent).

Men’s channel RTL 7 scored an average primetime audience share of 5.2 per cent among male viewers aged 25 to 54 (2021: 5.8 per cent).

Women’s channel RTL 8 attracted an average primetime audience share of 3.8 per cent among female viewers aged 35 to 59 (2021: 3.8 per cent).

RTL Z’s audience share in the demographic of the upper social status aged 25 to 59 decreased to 0.9 per cent (2021: 1.1 per cent).

This segment mainly comprises the fully consolidated businesses RTL Hungary, RTL Group’s Luxembourgish activities, RTL Group’s digital video company, We Are Era, the streaming technology company Bedrock and both RTL Belgium and RTL Croatia until the time of their disposals. It also includes the investment accounted for using the equity method, Atresmedia, in Spain.

| Revenue split – Other segments | 2022 €m | 2021 €m | Per cent change |

| Total revenue of other segments | 411 | 604 | (32.0) |

| Thereof | |||

| RTL Belgium (until 31 March 2022) | 40 | 176 | (77.3) |

| RTL Hungary | 113 | 116 | (2.6) |

| RTL Croatia (until 1 June 2022) | 19 | 46 | (58.7) |

| Other including elimination | 239 | 266 | (10.2) |

The Hungarian net TV advertising market was estimated to be up by 3.6 per cent in 2022 with RTL Hungary performing in line with the market. Total revenue of RTL Hungary was slightly down by 2.6 per cent to €113 million (2021: €116 million), mainly due to foreign exchange rate effects partly offset by organic growth. Accordingly, the business unit’s Adjusted EBITA was stable at €13 million (2021: €13 million).

With a combined primetime audience share of 28.91 per cent in the key demographic of 18 to 49-year-old viewers (2021: 30.5 per cent), the eight channels of the newly rebranded RTL Hungary were 0.3 percentage points behind the main commercial competitor TV2 Group with 14 channels. The Hungarian flagship channel RTL reached a primetime audience share of 15.0 per cent among viewers aged 18 to 49 (2021: 16.9 per cent) and remained the clear market leader, 1.1 percentage points ahead of TV2 (2021: 3.4 percentage points). The market-leading news programme, RTL Híradó, attracted 19.6 per cent of viewers aged 18 to 49 (2021: 20.0 per cent) while Hungary’s strongest TV infotainment brand, Fókusz (Focus), achieved an average audience share of 17.6 per cent in the commercial target group. The 11th season of The X Factor reached an average audience share of 32.0 per cent in the commercial target group. Even after 11 years, The X Factor is still the most-watched programme on RTL, with an exceptionally young audience: the average audience share among 15 to 29-year-old viewers was 48.4 per cent.

In November 2022, RTL Hungary launched RTL+, a subscription-based, advertising-free streaming service. RTL Hungary’s previous advertising-funded streaming service, RTL Most, and the advertising and distribution-funded streaming service, RTL Most+, were integrated under the packages RTL+ Light and RTL+ Active. RTL+ and RTL+ Active had 0.251 million paying subscribers at the end of December 2022. The most-watched programmes were the exclusive RTL-produced series A Király (The King), daily series, and reality formats such as ValóVilág powered by Big Brother.

In 2022, RTL Luxembourg confirmed its position as the leading media brand in Luxembourg. Combining its TV, radio, and digital activities (all three of which appear in the top-five media ranking in Luxembourg), the RTL Luxembourg media family achieved a daily reach of 79.2 per cent (2021: 82.1 per cent) of all Luxembourgers aged 15 and over.

Remaining the number-one station listeners turn to for news and entertainment, RTL Radio Lëtzebuerg reached 152,600 listeners each weekday (2021: 164,600). RTL Télé Lëtzebuerg – the only general-interest TV channel broadcast in Luxembourgish – attracted 137,800 viewers each day (2021: 138,700) and achieved a primetime audience share of 48.1 per cent in the target group of Luxembourgish viewers aged 15 and over (2021: 48.0 per cent). Luxembourg’s most visited website, rtl.lu, had a daily reach of 48.0 per cent (2021: 52.4 per cent) of all Luxembourgers aged 15 and over.

In February 2022, RTL Télé Lëtzebuerg broadcast the second season of the Luxembourgish hit crime series Capitani, which was watched by 44 per cent2 of all residents above the age of 16 either on RTL Télé Lëtzebuerg or on the streaming service RTL Play. RTL Play – the streaming service for audio and video content in Luxembourgish, French and English – recorded a total of 4.6 million plays during 2022. In July 2022, Luxair, the Luxembourgish Airline, launched its inflight entertainment platform in partnership with RTL Luxembourg, which allows passengers to access RTL Play and other content on their planes. In March 2022, RTL Luxembourg launched the web radio RTL Today Radio, Luxembourg’s only 24-hour English radio station. In July 2022, RTL Luxembourg created Luxembourg’s first podcast awards.

In 2022, Broadcasting Center Europe (BCE) strengthened its position in broadcasting via its online video platform (OVP), with services for the European Capital of Culture, Esch 22, the French fashion weeks, sports federations, and other institutions. For France Televisions, BCE built a state-of-the-art broadcast van for live productions and enhanced Fedcom’s Euroleague and Eurocup basketball matches with decentralised production services. Thanks to key agreements, BCE further developed its cloud services such as cloud storage, remote voice-over and editing while increasing its datacenter portfolio. Following the development of the new cloud-based platform for Enex, BCE extended its customer portfolio with the European Broadcast Union, which manages the news distribution of European public broadcasters.

In 2022, We Are Era further strengthened its leading positions in talent management and content production and expanded its direct sales and media solutions business. Successful productions included the RTL+ documentary Bolzplatzkönige – Mein Weg zum Profi (Kings of the Football Field – My Way to becoming a Pro), and content productions for the Google Brandcast and YouTube Works events. New clients included Der Spiegel and the Royal Belgian Football Association. In 2022, We Are Era successfully relaunched the VideoDays Festival for creators, brands and platforms. We Are Era’s revenue was up 3.2 per cent in 2022.

The Spanish net TV advertising market decreased by an estimated 4.6 per cent in 2022. On a 100 per cent basis, consolidated revenue of Atresmedia was slightly down by 1.2 per cent to €951 million (2021: €963 million), while operating profit (EBITDA) remained stable at €173 million (2021: €173 million), and net profit was €113 million (2021: €118 million). The profit share of RTL Group was €21 million (2021: €22 million).

The Atresmedia family of channels achieved a combined audience share of 26.4 per cent in the commercial target group of viewers aged 25 to 59 (2021: 27.4 per cent). The main channel, Antena 3, recorded an audience share of 11.5 per cent (2021: 12.2 per cent) in the commercial target group.

For more information on investments in associates see note 6.5.2 to the consolidated financial statements in the RTL Group Annual Report 2022.

1 RTL Hungary changed the publication of its audience figures from 2022 and is now using ‘Linear SHR’ audience share data, which is calculated without the ‘Other’ category of Nielsen

2 Ilres, 780 interviews 16+, May 2022

RTL Group believes that CR adds value not only to the societies and communities it serves, but also to the Group and its businesses. Acting responsibly and sustainably enhances the Group’s ability to remain successful in the future.

CR is integral to the Group’s strategy. The core RTL brand was repositioned in 2021 with a new identity, a clear set of brand principles and a new design reflecting the diversity at RTL. With this, RTL has been strengthened as Europe’s leading entertainment brand that stands for entertainment and independent journalism, as well as inspiration, energy and attitude. ‘We act responsibly’ is one of eight defined brand principles that guide the company’s action and define what RTL stands for. At the heart of RTL’s guiding principles and values is a commitment to embracing independence and diversity in its people, content and businesses.

In November 2022, the Corporate Sustainability Reporting Directive (CSRD) was adopted by the European Parliament. The new directive aims to significantly expand existing requirements for non-financial reporting. The reporting requirements of the CSRD will apply to RTL Group starting from the financial year 2024. This means RTL Group will again publish its own sustainability report from 2025 for the financial year 2024.

The information of the Combined Non-Financial Statement (which complies with the current European Directive 2014/95/EU and provisions by the law of 23 July 2016 regarding the publication of non-financial and diversity information in Luxembourg) can be found in the annual report of RTL Group’s majority shareholder, Bertelsmann SE & Co KGaA. Further information on RTL Group’s non-financial information can also be found in the GRI reporting of Bertelsmann SE & Co KGaA on bertelsmann.com.

The RTL CR Board unites executives from RTL Group and RTL Deutschland and was enlarged in 2022 following the combination of RTL Deutschland and Gruner + Jahr. The Board meets monthly to coordinate projects in key areas such as diversity, creative/editorial independence and climate protection, to develop new ideas and to ensure efficient use of expertise in both the Corporate Centre and RTL Deutschland.

The CR Board also meets annually with participants from specialist departments within RTL Deutschland, such as Youth Protection, the association Stiftung RTL – Wir helfen Kindern, Communications, and RTL Group’s Human Resources, Investor Relations and Compliance departments. The RTL Group CR Network – created in March 2014 and consisting of CR representatives from the Group and its business units – meets annually to share best-practices and knowledge. In addition, RTL Group established a Climate Task Force, consisting of members from all business units who meet to discuss, collaborate and define actions to reduce carbon dioxide emissions, with the target of becoming climate-neutral by 2030. In May 2022, RTL Group’s largest business unit, RTL Deutschland, established a department for sustainability and diversity, equity & inclusion (DEI), with a direct reporting line to the unit’s Chief Executive Officer.

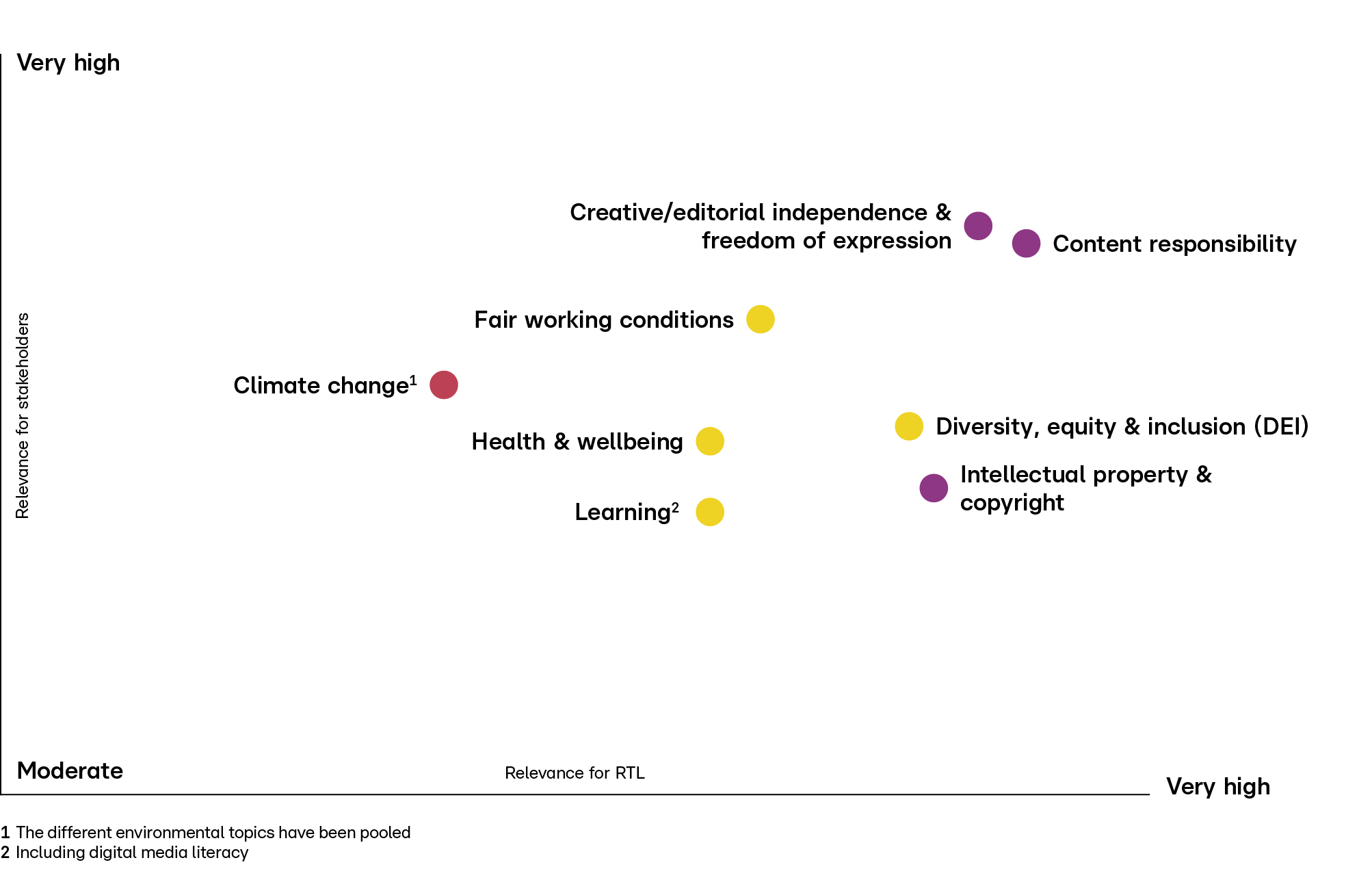

RTL Group’s CR activities focus primarily on the following issues: content responsibility, creative/editorial independence and freedom of expression, intellectual property and copyright, fair working conditions, diversity, equity and inclusion (DEI), health, safety and wellbeing, learning (including digital media literacy) and climate change. These issues were identified in a materiality analysis in consultation with internal and external stakeholders. The core of the survey was the assessment of 19 CR topics – internally, according to their relevance for the business, and externally, according to their relevance for stakeholders. The survey was conducted in 2020 in close consultation with the Group’s majority shareholder Bertelsmann.

RTL Group’s broadcasting and news reporting are founded on editorial and journalistic independence. RTL Group’s commitment to impartiality, responsibility and other core journalistic principles is articulated in its Newsroom Guidelines. Maintaining audience trust has become even more important in an era when news organisations and tech platforms have been accused of publishing misleading stories, and when individuals, radical political movements and even hostile powers post fake news on social networks to sow discord.

For RTL Group, independence means being able to provide news and information without compromising its journalistic principles and balanced position. Local CEOs act as publishers and are not involved in producing content. In each news organisation, editors-in-chief apply rigorous ethical standards and ensure compliance with local guidelines, which gives the Group’s journalists the freedom to express a range of opinions, reflecting society’s diversity and supporting democracy.

RTL Group has a diverse audience and a business based on creativity, and the Group therefore needs to be a diverse organisation. In 2022, the Group had an average of 12,975 full-time employees (total headcount: 18,623 including permanent and temporary staff) in more than 26 countries worldwide. They range from producers and finance professionals to journalists and digital technology experts.

RTL Group strives to be an employer of choice that attracts and retains the best talent, and equips employees with the necessary skills and competencies to successfully master the company’s current and future challenges. It does this by offering training programmes and individual coaching in a wide range of subjects, from strategy and leadership to digital skills and health, safety and wellbeing. It reviews and, if necessary, adjusts its training offers on an ongoing basis.

RTL Group’s corporate culture is founded on creativity and entrepreneurship. The Group strives to ensure that all employees receive fair recognition, treatment and opportunities, and is committed to fair and gender-blind pay. The same applies to the remuneration of freelancers and temporary staff, ensuring that such employment relationships do not compromise or circumvent employee rights. The Group also strives to support flexible working arrangements.

The Covid-19 crisis has deeply changed the world of work. The balance between working in the office and remotely is a relevant step to continue offering flexibility and efficiency for those employees whose functions do not require office presence.

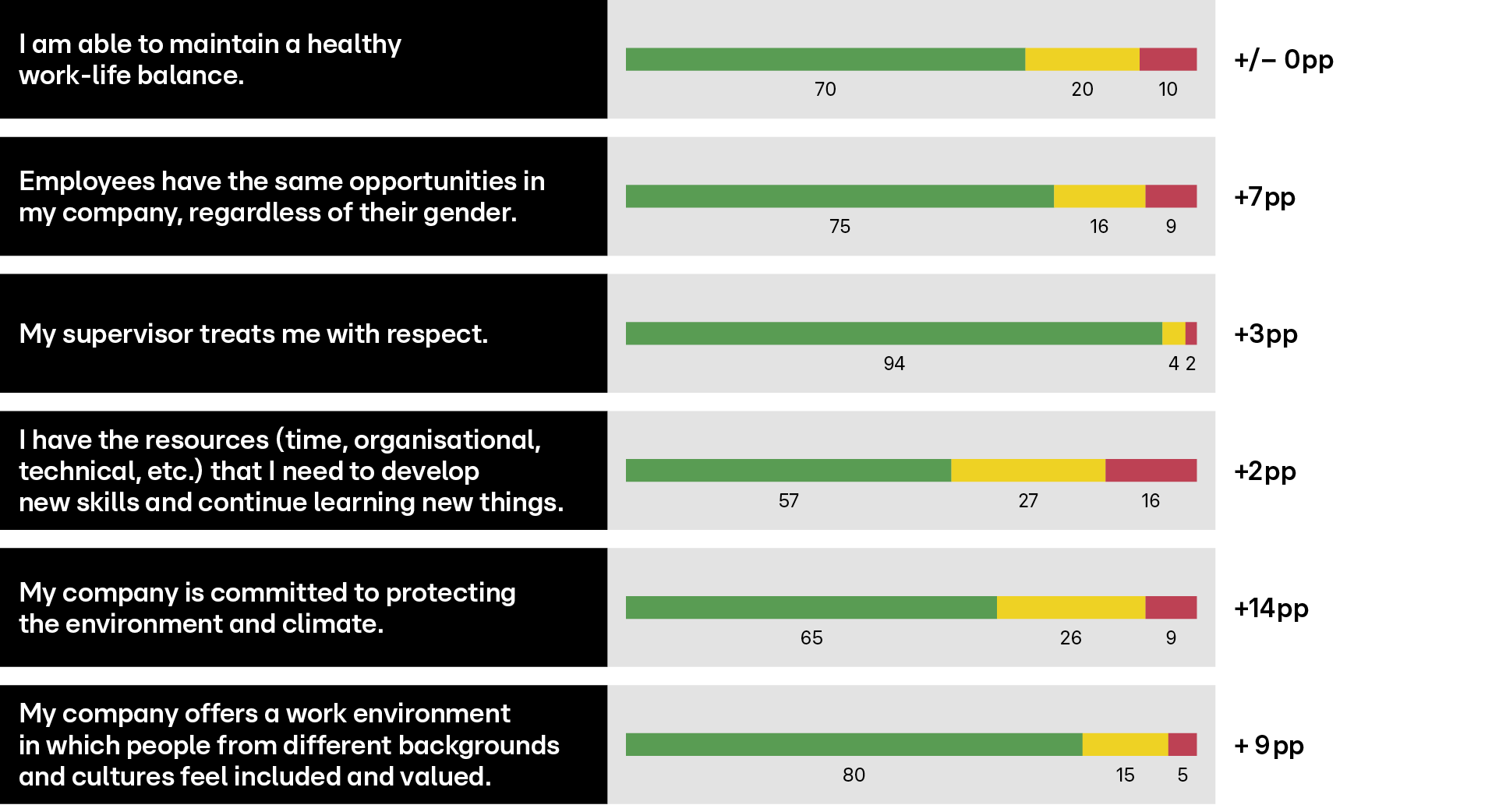

Every two years, RTL conducts its employee survey. In 2021, RTL Group received a response rate of 81 per cent, corresponding to 7,795 respondents from 74 companies across 23 countries and in 11 languages (excluding temporary workers and Groupe M6). Compared to the 2019 survey, RTL Group achieved higher scores and only positive deviations, particularly for CR-related topics, communication from senior management, engagement, and supporting the company’s strategy. Since 2021, the employee survey includes a new CR Index, to help track the progress of RTL Group-wide CR initiatives. The next employee survey will be conducted in 2023.

1 Calculation based on the average of positive responses to six questions of the 2021 Employee Survey in the following categories: Health & wellbeing; Diversity, Equity & Inclusion; Fair working conditions; Learning; Climate change

RTL Group’s commitment to diversity is embedded in its processes and articulated in its corporate principles. The cornerstone is the RTL Group Diversity Statement that reinforces the company’s commitment to promoting diversity and ensuring equal opportunity. It sets guidelines and qualitative ambitions for the diversity of the Group’s people, content and businesses.

RTL Group is committed to making every level of the organisation more diverse with regard to nationality, gender, age, ethnicity, religion and socio-economic background. The Group places a special emphasis on gender diversity. RTL Group’s workforce overall is balanced by gender (with 47 per cent men and 53 per cent women as at 31 December 2022) while women account for 36 per cent of top management positions (31 December 2021: 28 per cent), and 33 per cent of senior management positions (31 December 2021: 24 per cent).

Top management generally encompasses the members of the Executive Committee, the CEOs of the business units and their direct reports, members of the Management Boards, and the Executive Committee direct reports at RTL Group’s Corporate Centre. Senior management generally encompasses the Managing Directors of the businesses at each business unit, the heads of the business units’ departments and the Senior Vice Presidents of RTL Group’s Corporate Centre (unless classified as members of top management).

RTL Group’s long-term ambition is for women and men to be represented equally at all levels. In 2022, RTL Group’s Executive Committee reviewed the Group’s objectives and set the following quantitative targets: to increase the share of women in top and senior management positions to at least one third by the end of 2022 and at least 40 per cent by the end of 2025. The Group reports on its progress towards these diversity targets each year. At the end of 2022, the ratio of women in top and senior management positions was 34 per cent, up 14 percentage points compared to 2016 when RTL Group reported those measures for the first time (2016: 20 per cent; 2021: 28 per cent). By achieving its 2022 target, RTL Group reached an important milestone on the way to ensuring at least 40 per cent of top and senior management positions are held by women by the end of 2025.

The importance of diversity is also reflected in the content the Group produces. Millions of people who turn to RTL Group each day for the latest local, national and international news need a source they can trust. RTL Group therefore maintains a journalistic balance that reflects the diverse opinions of the societies it serves. The same commitment to diversity applies to the Group’s entertainment programming: it is essential for RTL Group to create formats for a wide range of audiences across all platforms. Content should represent the diversity of society, so many different segments of society can identify with it.

In 2022, Fremantle continued to make progress towards building an equitable and inclusive culture across its business and content. During Pride month, for example, Ryan J Brown, writer and creator of Wreck, a six-part comedy horror series for the BBC, highlighted the importance of queer representation in TV with predominately LGBTIQ+ lead characters.

Fremantle also continued its partnership with The TV Collective on the Breakthrough Leaders programme in the UK, supporting 150 black, Asian and minority-ethnic future leaders. In Sweden, Fremantle’s leadership team is participating in an external mentoring programme, All of Us, for young people of colour in the creative industries and supporting the WomenUp programme – which consists of 40 women and their mentors – to address the female leadership gap. In the US, a partnership with Fresh Films supports 400 young people from under-represented backgrounds based in 27 national locations nationwide.

Inclusive casting and storylines across Fremantle show – two things continued to provide a platform for different voices and perspectives, influence authentic storytelling, and promote empathy and understanding. Heartbreak High was recognised for its diverse casting and nuanced storytelling, featuring young Australians who are from First Nations communities, queer, disabled and/or neurodivergent. The series Planet Sex, fronted by Cara Delevingne, had a predominantly female and non-binary crew, and was filmed across the world incorporating intersectional LGBTIQ+ communities with a global reach and outlook.

In Germany, RTL Deutschland initiated its first diversity week to place LGBTIQ+ people at the centre of its content. RTL Deutschland’s diversity week created awareness on different platforms, including a marketing campaign with RTL testimonials from the queer community and special formats such as the RTL primetime show Viva la Diva – Wer ist die Queen? or a LGBTIQ+ print special in the educational magazine Geo Wissen. Furthermore, the German RTL+ original film Weil wir Champions sind (Because we are champions) – which tells the story of an inclusive basketball team – featured nine actors with disabilities.

RTL Nederland focuses on diversity, equity and inclusion both on its linear channels and its streaming service Videoland. In 2022, RTL Nederland launched the first season of the drag entertainment show Make Up Your Mind and released the second and third seasons of the gay dating show Prince Charming on Videoland. Videoland original documentaries such as Nikki, De Wereld Van Eva and Tussen De Lakens Met Geraldine also focus on societal issues.

As a leading media organisation and broadcaster, RTL Group has social responsibilities to the communities and audiences it serves. These responsibilities are particularly serious when it comes to children and young people. The Group complies fully with child-protection laws and ensures its programming is suitable for children – or broadcast when they are unlikely to be viewing. RTL Group also strives to give back to its communities by using its profile to raise awareness of, and funds for, important social issues, particularly those that might otherwise receive less coverage or funding.

As part of this support, the Group provides free airtime worth several million Euro to charities and non-profit organisations to help them raise awareness of their cause, as well as donating significant amounts of money to numerous charitable initiatives and foundations. Finally, RTL Group’s flagship fundraising events (Télévie in Luxembourg, and RTL-Spendenmarathon in Germany) raised €45,434,477 for charity in 2022 (2021: €34,307,8691 still including Télévie in Belgium).

1 The total amount of donations for 2021 was restated

RTL Group’s primary mission is to invest in high-quality entertainment programmes, fiction, drama, news and sports, and to attract new creative talent to help the Group contribute to a vibrant, creative, innovative and diverse media landscape. Strong intellectual property rights are the foundation of RTL Group’s business, and that of creators and rights-holders.

RTL Group’s Code of Conduct and Information Security Policy set a high standard for the protection of intellectual property. All employees are expected to comply with copyright laws and licensing agreements and to put in place appropriate security practices (password protection, approved technology and licensed software) to protect intellectual property. Sharing, downloading or exchanging copyrighted files without appropriate permission is prohibited. Violations can be reported to the Compliance department via its reporting channels, which include a user-friendly speak-up system.

The foundation for lasting business success is built on integrity and trustworthiness, and RTL Group has zero tolerance for any form of illegal or unethical conduct. Violating laws and regulations – including those relating to bribery and corruption – is not consistent with RTL Group’s values and could damage the Group. Non-compliance could harm the Group’s reputation, result in significant fines, endanger its business success and expose its people to criminal or civil prosecution.

The Compliance department provides Group-wide support on anti-corruption, anti-bribery and other compliance-related matters. In addition to centralised management by the Compliance department, each business unit has a Compliance Responsible in charge of addressing compliance issues, including anti-corruption.

For information about RTL Group’s Audit Committee see page 87.

Representatives of RTL Group management sit on the RTL Group Corporate Compliance Committee. The committee, which is chaired by RTL Group’s Chief Financial Officer, is responsible for monitoring compliance activities, promoting ethical conduct and fighting corruption and bribery. It is kept informed about ongoing compliance cases and the measures taken to prevent compliance violations.

The RTL Group Anti-Corruption and Integrity Policy is the Group’s principal policy for fighting corruption. It outlines rules and procedures for conducting business in accordance with anti-corruption laws and Group principles.

RTL Group’s policies, including anti-corruption and integrity, anti-trust and compliance organisation, were updated and streamlined in 2022. The policies are split into ten categories, with a Business Process Owner for each category, who is the main contact for any questions regarding the respective policy.

Respect for human rights is a vital part of RTL Group’s Code of Conduct, which includes a decision-making guide that clarifies how to comply with the company’s standards in case of doubt. The Group’s commitment to responsible and ethical business practices extends to its business partners. In 2017, RTL Group established the RTL Group Business Partner Principles, which sets minimum standards for responsible business relationships. To cover all centrally important aspects of human rights in one place, RTL Group published a specific Human Rights statement in 2022. The statement explicitly refers to the standards of the Universal Declaration of Human Rights and the United Nations’ Global Compact and applies to the entire Group. To report suspected human-rights violations or unethical practices, employees and third parties can contact RTL Group’s compliance reporting channels (directly or through a web-based reporting platform) or an independent ombudsperson. In all cases, they may do so anonymously.

RTL Group is a media company with no industrial operations and therefore does not consume significant amounts of raw materials or fossil fuel and is not a major polluter. The Group is mindful that resource conservation and climate protection are key challenges for the 21st century. For this reason – together with employees and stakeholders – RTL Group is committed to minimising its impact on the environment, by reducing its energy use and its direct and indirect greenhouse gas (GHG) emissions. It codified this commitment in February 2018 by issuing its Environmental Statement.

RTL Group has measured and published its carbon footprint since 2008. Serving as the key indicator for evaluating and continually improving the Group’s climate performance, it was formerly calculated based on each country’s average energy mix. To improve data quality, since 2017 it has been calculated based on the emissions associated with the Group’s individual electricity supply contracts. This new, more detailed baseline takes into account hotel stays, refrigerant losses, commuting, IT devices and own and commissioned productions, as well as electricity consumption, paper, business travel, water and wastewater.

At the start of 2020, RTL Group decided to become carbon neutral by 2030. It will reach this goal in two steps. By 2025, the Group will be carbon neutral with regards to company-related carbon dioxide emissions. Here, the focus will be on switching to green electricity, reducing business travel and offsetting the remaining emissions. By 2030, the Group will reach carbon neutrality, including both company-related emissions (scope 1 and 2) and emissions from the production of its programmes and products (scope 3).

As part of its aim to reduce carbon emissions, Fremantle collaborated with Bafta’s Albert to launch a carbon calculator and certification toolkit for the TV industry in January 2021. The toolkit is an authority on environmental sustainability, allowing carbon emissions caused by content productions to be calculated and, above all, provides a controlled way of reducing those emissions. Examples from 2022 include the Wildside films Siccità and L’immensità, both of which were Albert certified.

In 2022, seven shows from RTL Nederland were certified sustainable or carbon neutral by Albert for the first time. Those formats include Love Island and Beat the Champions. In addition, more than 20 other shows were monitored by Albert. This is an essential step towards the decarbonisation of productions in the Netherlands. In November 2022, the channels and platforms of RTL Nederland raised awareness of plastic pollution during the campaign week RTL Samen Groener (RTL Greener Together).